What is petty cash?

With controls and transparent transaction documentation, businesses can uphold financial accountability and safeguard their assets efficiently and systematically. The amount of petty cash that is allowed changes depending on the company’s internal policies. Depending on the size and frequency of transactions, this amount is set. As we mentioned earlier, petty cash is used instead of cash or check to pay for small expenses in a company.

These purchases can only be made with cards, making petty cash funds obsolete. HighRadius’ automated accounting software offers a comprehensive solution for efficient cash management. The account reconciliation function ensures accurate tracking of petty cash transactions, reconciling invoices, and maintaining a precise balance sheet. Financial close capabilities expedite bookkeeping processes, allowing for faster closure of books. Anomaly management identifies errors and omissions, enhancing accuracy. Cash on hand is any accessible cash the business or liquid funds have.

Reconciling Petty Cash

For offline, petty cash transactions can be recorded using slips, also known as petty cash vouchers, which detail the transaction and help maintain transparency within your company. Reconciliation of a petty cash account involves comparing the remaining cash balance with the total recorded transactions in the petty cash log. Discrepancies should be investigated, and corrective actions should be taken if needed. This reconciliation process helps maintain the accuracy and integrity of the petty cash system and ensures that the fund is used appropriately. The petty cash fund is reconciled periodically to verify that the balance of the fund is correct. Typically, as the petty cash balance falls to a preset level, the custodian applies for additional cash from the cashier.

- Having cash on hand was convenient for times when merchants didn’t have card readers.

- Commercial transactions are increasingly cashless—even at small retailers and restaurants, where purchases traditionally have relied heavily on coins.

- For example, say your small business provides specific services for local business owners.

- To establish a petty cash account , the business writes a check to a petty cash custodian.

- Once the process is complete, the available cash amount should always align with the amount recorded in your petty cash log.

Over time, you can analyze how frequently you reach this line and then adjust the petty cash fund limit accordingly. For additional security, you can require the custodian to keep a log of who refunds are given to. You might even enter the names of employees who request funds and why they may need them—it might indicate an expense you weren’t aware of. If you’re a small business owner, it’s important to understand how petty cash can be used so you can account for it correctly in your books. “Petty cash” is the term used to refer to the money a business keeps handy for unexpected expenses that occur. The cash custodian is given the authority to maintain the funds and use them for expenses according to standard operating procedures and regulations.

Why Do Businesses Use Petty Cash Funds? 7 Reasons You Should Know

In a company, writing a check for every single expense is an arduous task and is not entirely possible. That is why paying through a small amount of cash is a much easier option for minor expenses like office supplies, meals, etc. You set your own rules about which expenses can be reimbursed and how much the petty cash account can cover.

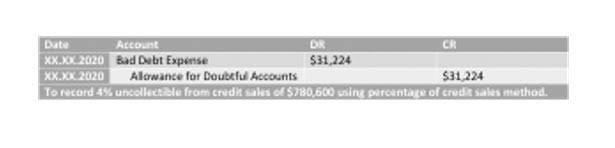

At this point, the petty cash box has $75 to be used for small expenses with the authorization of the responsible manager. The journal entry to establish the petty cash fund would be as follows. When replenishing the petty cash fund, the cashier ensures accurate balances of receipts in the petty cash book.

How To Set Up and Manage a Petty Cash Account

A petty cash fund aims to offer business units enough cash for minor expenses, streamlining the reimbursement process for staff and visitors. Think carefully about the expenses covered by petty cash and establish clear guidelines. Petty cash should cover small, necessary expenses that require immediate funds. It’s also crucial to consider how your business operates and what it needs to function efficiently.

- Companies must introduce strict internal policies and controls to manage petty cash.

- It might seem tedious to log every tiny expense in this way, but there’s nothing petty about petty cash expenses.

- The standards are set, and regulations are made in the financial system.

- But it can be helpful to keep paper slips too, along with receipts from the purchases or payments (if possible).

- Fund the fund through a withdrawal from an ATM or by writing a check, marking it clearly in your accounting records.

- The over or short account is used to force-balance the fund upon reconciliation.

Sometimes, custodians perform a weekly or monthly reconciliation to track the cash balance. Companies often maintain a petty cash fund balance, and this amount will vary based on your company’s needs. Depending on your expenses, it could be anywhere between INR 500 to INR 5000. Therefore, always set a reimbursement limit to avoid cash leakage and to overpay.

The petty cash is controlled through the use of a petty cash voucher for each payment made. The expenses will be recorded in the company’s general ledger expense accounts when the petty cash on hand is replenished. The cash must be taken from the checking account to replenish the petty cash box after the bookkeeper why do businesses use petty cash funds? records all expenses in the books. The cash transfer must be recorded by debiting petty cash and crediting the checking account. Just like any other transaction, petty cash transactions need to be monitored and recorded. However, the transactions are recorded in a manner that oversees the replenishment of funds.

Cash Me If You Can: The Impacts of Cashless Businesses on Retailers, Consumers, and Cash Use – Federal Reserve Bank of San Francisco

Cash Me If You Can: The Impacts of Cashless Businesses on Retailers, Consumers, and Cash Use.

Posted: Mon, 19 Aug 2019 07:00:00 GMT [source]

The individual purchases don’t need to be recorded officially, just the actual funding. Each time you tap into a petty cash fund—that is, take money out—a slip or voucher should be filled out. This acts as a receipt, logging the amount of the withdrawal, the date, the purpose, and other details. Increasingly, these slips are electronic ones, entered in a digital spreadsheet or ledger.